In a special Plantbased Business Hour podcast, CEO of VegTech™ Invest, Elysabeth Alfano, breaks down the main points from Beyond Meat’s earnings call and sheds light on how the company may move forward given the stronger balance sheet and what that could look like for 2024 and beyond.

From the initial stock surge to the more tempered price of today, Elysabeth discusses

- Why did analysts react favorably to moderate news?

- Does the brand still exhibit strength in any area after more than two years of difficulty?

- What could 2024 and 2025 look like for the company amid cost restructuring and innovation?

- Is there a path to profitability?

- Can anything be extrapolated from the increase in international sales, given revenue declines in 2023 and guidance for stabilization, not growth, in 2024?

This episode was different than usual, as it was audio only. With no video clip we are including the transcription of the full podcast for you below.

Hi everyone, I’m Elysabeth Alfano, CEO of VegTech Invest. I’m happy to do a very special Upside & Impact: Investing for Change podcast, given the wild ride of Beyond Meat’s stock price of late. Now, wild rides are not new for them, but they did have an earnings call last week. That would have been Tuesday, February 27th, and it created quite a stir.

So Chief Investment Officer of VegTech Invest, Dr. Sasha Goodman, and I thought it might be a good idea to break down just what’s going on behind that stock and why analysts reacted the way they did. The stock popped up to 106% in after-hours trading. By the next day, February 28th, that would have been Wednesday of last week, the stock had held on to some of those gains, 31% rising to $9.83 up from $7.52. But we’re talking about seven dollars and fifty-two cents. So quite a plummet for the company as the world might know.

So, at some point it had been in the very high highs prior to Covid and has had a tough time ever since. Its earnings calls have been very tough for the company. So, with this earnings call, which had some- perhaps we’ll say good news, or perhaps we’ll say it was a good response from analysts, maybe it’s time to take a deeper dive and see just what’s behind that. With that in mind, I’ll give a little bit of history. So, as I said, Beyond Meat, no stranger to a wild ride.

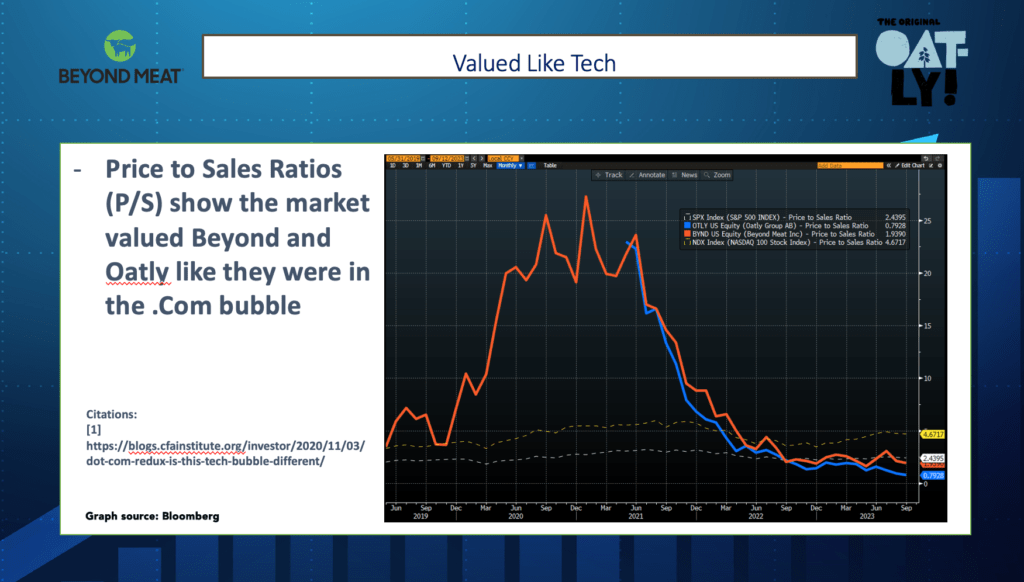

The company IPO’d in 2019 and it had the highest stock rising 163% in one day. It was the largest rise of an IPO stock since 2008. It was a very exciting time. It was a pre-Covid time. Yes, remember, take yourself back to what life was like prior to Covid. So, 2019, quite an exuberant time. The valuation back then, however, was more aligned with tech companies, specifically tech companies of the dot-com bubble, more than with consumer staple and food companies. So, we should have an image of that if you are listening to audio and you want to go to etfcentral.com and find the link to this podcast blog post.

So, tech companies trade at higher multiples. They also have faster growth, particularly the dot-com bubble tech companies were trading at multiples of around 30. Food companies, consumer staple companies usually trade more like one to three maxima. Food companies tend to have slower growth. That’s why the lower multiple. Now, food tech is kind of a hybrid of the two, tech company and food company, although the history has yet to be written for what food tech will do in the markets and given that uncertainty the market really took to bringing down the valuation of Beyond Meat to really be much more in line with the consumer stock company.

So, the retail public at home during Covid, everybody was investing in the market like they were playing video games. I mean, there’s just a real retail exuberance to be in the market and they were perhaps not looking at valuations and some of the stock prices as it went into the one hundreds and then the two hundreds really made no sense. That ultimately came down as retail investors took a back seat, went back to work and analysts took a hard look at the company. So, let’s talk about that.

What does Beyond Meat look like hypothetically? I cannot speak for analysts, but I’ll try to put on their glasses and say what does Beyond Meat look like through an analyst’s eyes? Well, from the times that I have either met Ethan Brown personally or seen him speak in public, he, like every founder I’ve ever met speaks with a dream. He has a vision for the world. He’s a founder who’s very excited about the future and that’s great if you’re here to sell a dream, but analysts aren’t interested in dreams.

Maybe I can even say Wall Street, particularly in the time of 2020, perhaps less so now when the message of the damaging impact of our current food supply system is becoming common knowledge, but it wasn’t the case in 2019 and 2020. So, then you’re selling a dream in 2020 to analysts who maybe have never heard about the connection between the environmental impact of our animal-based food supply system and our water, deforestation, these kinds of things. So, if you’re selling an environmental dream in 2020 or 2021, I’m not sure that that’s really going to fall on any analysts’ ears.

They just want to see consumer demand, revolutionary IP, solid business metrics, and a path to profitability if not profitability straight out of the gate. That’s not going to be the case with Beyond Meat from a Wall Street perspective. A relatively young company as well as a relatively small company, so that won’t be the case for that company. They do not have profitability but if that’s not in the bag so to speak then analysts want to see revenue growth and usually again, cannot speak for all analysts but just making my estimations, usually before you see a buy rating, you’d want to see good revenue growth. Now, Beyond Meat’s revenue growth was down 18% in 2023 and that took them to $343 million. So not out of the gate by any means.

So, if their revenue growth was down 18% in 2023, why would analysts have reacted positively to their Q4 earnings call that took place on February 27th? We’re going to get to that in just a second. Another thing that analysts look for, again not the dream. They’re not really interested in hearing how meat might go away as many of them like meat or let me say it might go away in part. Obviously, meat’s not going away. Everyone knows that, but little side note, meat is a $1.4 trillion industry. I think Beyond Meat would be over the moon to take 10% of that, even 5% of that. So that’s really what they’re talking about when they talk about that big dream, that big win.

But again, that’s probably going to fall flat on analysts. So, they’re looking for revenue growth and a PE ratio, which is noted as a share price divided by earnings. But we just said Beyond Meat doesn’t have earnings. Well then what does that mathematical equation look like if you’re taking the share price divided by a negative number? It doesn’t really work for analysts. So now you have a dream they don’t care about, downward revenue growth and no real functioning PE ratio. So, what are they going to lean heavily on?

Well, the next thing is, “let’s hear from the CEO.” This is where the earnings calls come into place. So, they’re really looking for an unemotional CEO. That would be the opposite of someone selling a dream. An unemotional CEO and a CEO who can be very consistent and reliably give guidance as to the financial expectations for the company. When will the company be profitable and if so by how much? How long will that take? What will be the path to getting there? What is the path to profitability? How can you shore up and have a more solid stronger balance sheet? So that’s what they’re looking for in these earnings calls.

Now, historically Ethan Brown has leaned heavily on the dream and not always been accurate in predicting the financial expectations and that has always led to being downgraded by analysts because if the CEO can’t call their business three to twelve months out, that would give analysts, in my estimation, a reason for pause. Because much of earnings calls is about managing analysts’ expectations, consistently hitting the quarterly expectations and earnings calls will give analysts confidence that the CEO has control of that business.

Now consistently missing their quarterly expectations, not being able to perhaps write the ship quarter after quarter will do the opposite. So, it has been a very tough ride for Beyond Meat, but recently they had a little bit of a favorable reaction from analysts. So, I really want to go over what that might look like. Before we do, I want to say one thing. Many folks are probably saying, “Well God what’s there to love here? I mean they’re missing their earnings calls, their growth is down, their revenue’s down.” You know, I don’t want to take anything in a vacuum.

We’ve talked about Covid and the exuberance of 2019 and 2020. I think everyone felt the pain of 2022 and quite honestly 2023 unless you’re NVIDIA, which most companies aren’t. So, you know, you’re talking about recovering your balance sheet from Covid restaurant closures. Beyond Meat was very strong in food service so that was a big punch in the gut to recover from. Supply chain disruptions, we don’t talk about them too much today. We’re kind of back to a normal supply chain, but you know, you can’t have pain like that and snap a finger and have it be over. So, they’re still recovering from that.

China’s economic crash to, in my estimation, Beyond Meat’s credit it looks for global distribution and as a brand that had global recognition China was a part of that equation and of course, we know what’s going on in China’s economy. So that’s another headwind. You add to that global inflation for, we talked about Beyond Meat being relatively small, for a company that does not yet have scale. So, they’re going to have higher prices. So, you have global inflation on top of an already more expensive product.

Many don’t know this, but there’s been a consistent effort from the meat lobby. The Guardian talks about this, it’s not my opinion, this has been shored up by journalists going against the sector in general, which might prove to be competitive to the meat industry in time, but let’s face it, the only real consumer facing brand. At VegTech Invest we invest up and down the supply chain of food systems transformation, so we know of 34+ companies that are focused on sustainable food systems transformation, but from the consumer perspective they see Beyond Meat and that’s all they see.

So, if you’re going to go after one company that in the consumer’s mind represents the sector, you’re the meat industry, you’d go after Beyond Meat, and they’ve gone after them with big budgets. So, you can’t pretend that it doesn’t exist and then in awful uncertain times people don’t like to reinvent the wheel. They go back to the tried and true that they can afford, and they love to eat and that’s a burger. So, you put all those things together and there have been serious, not their own doing, headwinds for this company.

They did have a pop last Tuesday and Wednesday. They haven’t been able to hold on to it in full. As of the recording of this podcast the company just about at the close of business on Monday, March 4th it is at $8.58. So, they’ve held on to a little bit of the gains from last week’s earnings call, not held on to all of it. But even regardless of the actual number, analysts, for, will say they are happy with the company. Why would that be when Beyond Meat’s guidance going forward for 2024 was that they would be the same as 2023?

So, they wouldn’t give the expectation for or guidance for growth, but they’re just saying we’re going to stop the bleeding and keep our revenue at about $345 million. So why would analysts be so happy about that? Well, Ethan Brown was able to talk about continued traction at McDonald’s. So, what Q4 did indicate was that they were up in two things. Ethan often gets his guidance wrong. He did not in Q4 of 2023. So, revenue was $73.7 million in Q3 rather than the expected $66.8 million. So, they not only nailed the expectations, but beat them. Domestic sales remained tricky, but international sales were up 22% in retail and 34% in food service.

Brown talked about traction at McDonald’s. They’ve always been strong with McDonald’s internationally. Countries like Austria, Germany, Ireland, The Netherlands, U.K., Malta- I love that Malta makes the list, good for Malta. Portugal, Slovenia, Switzerland, not small particularly when you’re looking at Germany and the U.K. So that is wonderful, but also that he was able to nail that guidance. My expectation is that this is the Ethan Brown analysts have been wanting to see since that IPO. They’ve been wanting to see a more unemotional Brown, a less focused on the dream Brown. And then here’s really the kicker: What was monumentally different?

So those are some smaller things that are different. What was monumentally different is that in 2023, Brown brought operational spending to $107.8 million from $320.2 million. He brought operational spending down about two thirds. Now that’s the CEO who’s not focused on the dream but is focused on the balance sheet. That’s someone who’s serious about finding a path to profitability. It’s action, not rhetoric and I think all these things combined are really what made the streets say, “Okay, by no means is anyone out of the woods, but that’s what we’d like to see” and the stock was rewarded for that.

You know, Ethan Brown might still have the dream of shifting the global food supply system to be more sustainable, healthier for people and cruelty-free, but that’s not the purpose there, of that earnings call. So, it was nice to see that headlines were everywhere last week. Again, Bloomberg reported that the stock was up 31% the day after and 106% up in after-hours trading and it seemed like a happy 24 hours, let’s say, for the company.

So where do we go from here? You know, that’s just one earnings call. Obviously, we’re talking about enormous headwinds like China’s economy and attacks from the meat lobby. So, this doesn’t rectify itself in a day. Where do we go from here? Well, 2023 saw operational down, as I said, two thirds, but it didn’t see a decrease in innovation. So, the brand came out with its clean label, always cholesterol-free, low-saturated fat, plant-based steak tips. Those were well received. In 2024, it has plans for a cleaner label burger. So, to the credit of the company, it continues to innovate, and I believe we’re on version three of that burger.

So less saturated fat, a cleaner label without sacrificing taste, going for that healthier profile that the brand’s always, always after. Side note, it’s not that hard in the sense that, you know, you’re comparing yourself to a burger which is high in saturated fat, induces trimethylamine N-oxide, has antibiotics, hormones, has no fiber and is filled with cholesterol. So, it’s not going to be that hard to beat that, but the brand continues to push that label to just get cleaner and cleaner. So that’s wonderful, but also, I think 2024 brings a perhaps hard decision, a bittersweet decision, but really, again, showing the strength of the CEO.

They’re discontinuing the Beyond Meat jerky. Now this, in its day, when it was announced was meant to be really a feather in the company’s cap. They were partnering with PepsiCo. They were going to get immediate distribution through PepsiCo, which would be the attraction there, but for whatever reason, be it logistics and/or other, that was not a profitable endeavor. So, Brown made the decision to nix that product and that’s going to be a cost saver, I believe, for the balance sheet. And again, stock was rewarded for this kind of focus towards the numbers in the balance sheet.

Now the good news in that sense, is the company predicts the bleeding will stop for revenue declines, that it can maintain 2023 revenue into 2024 and it will continue innovation. It has slashed operational spending. These are significant and that it’s focusing on a path to profitability. If we could ever get out of this economy, then again, things not in his control- if we could get out of this economy and food systems transformation taking root as CEO Brown had predicted if I may say back when he started the company, but really communicating that to the world in 2019 and 2020 with food systems transformation taking root.

We see things like the World Bank saying that food tech investing is akin to climate tech investing, that is wants to see $300 to $400 billion invested in food tech each year for the next ten years as we try to mitigate climate change and our animal-based food systems being responsible for 32% of the world’s global methane emissions. You just won’t impact climate change if you don’t address that methane number given the potency of methane and its shorter shelf life. That’s the silver lining there. The short shelf life on methane allows you to impact climate change by tweaking that methane number in addition to deforestation and biodiversity loss.

Animal proteins being the largest driver, the biggest driver of deforestation and therefore biodiversity loss. So, you see these pushes coming from the United Nations Environmental Programme, the Food and Agricultural Organization of the United Nations and the World Bank, as well as others. So, food systems are finally getting to government spending, philanthropic spending, and Wall Street spending. So, the timing is right for the company. If they can get out of this economy, if they could start focusing smartly on that balance sheet, as they seem to be doing. There’s reason to believe in time they could pull themselves out of this.

There’s great branding. For better or worse, they represent the sector and there is some IP in that they continue to innovate. Of course, nothing is rainbows and unicorns. So, the company has had enough cash to fund operations for the next 12 months. It does have that. It expects that it will need to raise capital in 2024 through the issuance of debt or equities and securities. So, you know, this action could dilute it in the company. For current shareholders that’s going to reduce the market price. So, you know, they’re not out of the woods, but there’s a reason to look at the company holistically in the economy that we’re in, in the election year that we’re in, in the uncertainty that plagues all of us as investors and as eaters, as well as what the company has at its headwind out of its control and what it has at its headwind in its control.

A lot of that consumer demand is coming down again due to inflation, high prices against a subsidized competitor. That’s what the meat industry is. Meat lobby attacks and inflation. These are just a lot of things going on, but the brand standing up for itself and really hacking away at those expenses. I know that made me happy. So, I will conclude there. I just thought I would go out of my way to do a special debrief on the last earnings call for Beyond Meat. In our estimation at VegTech Invest, we think analysts were pleased to see what it could look like for the company in the future. A mixed bag, but there’s good there.

You know, a little bit of luck could help. They haven’t had that at all. But you know, if the economy turns around, let’s see what that could look like as we march really into 2025 which is perhaps the year that we all have our eyes on as this year is off to a volatile start. Beyond Meat, no exception, having a volatile week last week, slightly holding onto its gains, but not holding onto everything.

Again, as I close this podcast, refresh my screen one more time. After its pop last week from its earnings call, the Beyond Meat stock as of Monday, March 4th is $8.57 cents. As always, thanks for listening to the Upside & Impact: Investing for Change podcast. You can always reach me on LinkedIn if you’d like to ask me more questions. I’m happy to entertain them at any time. If you have a guest that you would like to suggest being on this podcast, which is distributed by the New York Stock Exchange etfcentral.com, their podcast platform, please send me your guest suggestion.

This podcast is on iTunes and Spotify, so I appreciate your reviews. Five stars does help. Thanks, everybody. I will be back next week and have a wonderful day.

New episodes are out every week. Never miss the Plantbased Business Hour or Minute. Subscribe on iTunes and Youtube, and sign up for the newsletter. Follow Elysabeth on Linkedin. For information on Plant Powered Consulting, click here.