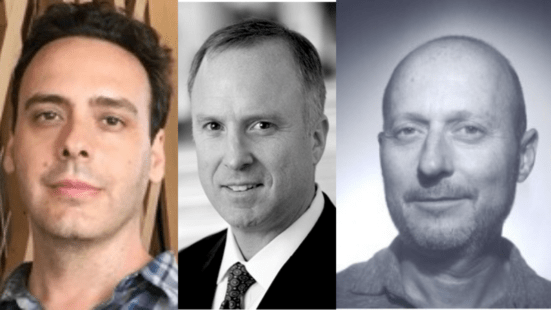

VegTech™ Invest President, Sasha Goodman, Managing Partner of Kambio Partners, Ken Kornbluh, and Founder of DEA Wealth, Chris Buck, join me on the Plantbased Business Hour to discuss VegTech™ Invest, the making of the VegTech™ Plant-based Innovation & Climate ETF on the New York Stock Exchange, and the potential secular trend of plant-based innovation.

Specifically, we discuss

- The inspiration for creating VegTech™ Invest, Advisor to the VegTech™ Plantbased Innovation & Climate ETF,

- The Steps and challenges to creating an ETF,

- The Robotics and Semiconductor trends and how the Plant-based Innovation trend is mirroring these large-scale, secular trends. .

A short clip and transcript from our conversation is below. The long-form video is here.

Elysabeth: Before we started this ETF, VegTech™ Plant-based Innovation & Climate ETF, we were working together about 9 months ago and thinking that this maybe wasn’t even going to happen. Maybe you can tell everybody how we started working together.

Dr. Sasha Goodman: Sure, we were both involved in various plant-based groups online including GlassWall Syndicate and it turned out you lived close by. We were both creating at the time a list of plant-based stocks and, you know, we didn’t see any public fund on the market that was doing it so we just said we want to do it the right way. So, we decided to make our own fund.

Elysabeth: You and I come from venture capital but very few people can do venture capital. The smallest amount to get in and support a company would be around $25,000. That’s a lot of money for people, but in the public markets you have more options. And so we started putting together this list and then we thought we’ll make the list public so that everybody can have this knowledge and once we did that people were just calling me at home. People were tracking me down saying, “I want to invest, but what can I do with this list?” I told them, “Well I just gave you the list.” But that wasn’t enough. “No, no, please put together an ETF for me. Please help me invest.” And so it’s been ten months, actually twelve plus moths, of deep due diligence and lots of research and struggle.

Chris, I’ll throw it to you. You jumped on the VegTech™ bandwagon early on. Before you were helping us and creating your own firm at DEA Wealth, you were with ROBO Global. ROBO Global, for those who don’t know, is one of the leaders in thematic ETFs. A thematic ETF is what VegTech™ is, so it’s an ETF that focuses just on one theme and the companies in that theme. You had a long time experience with ROBO Global and robotics and you saw a secular trend there. Maybe you can talk about some of the similarities that you saw between the robotics secular trend and now what you’re thinking the plant-based innovation secular trend could be.

Chris Buck: I was fortunate enough to learn a lot at Black Rock where I ran a capital market and looked over three to four hundred different ETFs and had the opportunity-a very similar story. A bunch of engineers were around saying, “Guys, there’s ubiquitous automation. The processing capability is a parabolic exponential increase. There’s declining cost curves and there’s going to be ubiquitous automation and there are going to be companies that are focused on driving the fourth industrial revolution.”

So, I became involved in the company and the more I learned about it the more it seemed like kind of a simple but true, no-brainer of an investment. The challenges are finding the experts that can capture that growth in an investable product or strategy. So mainly what I learned from ROBO Global, you know, when I was introduced to Sasha and Elysabeth, I said, “Wow this is a very similar feel with supply and demand and so I started diving deeper into the demand.

You know we’re going to get into 2030 which is eight years away or so, we’re going to have 8.6 billion people. How do we feed that many people without killing the world? And it’s actually a pretty big challenge. Fortunately, there’s a lot of capital and a lot of venture capital and a lot of companies trying to solve that problem. And every angle that I came into it, it felt very similar to robotics and automation, that there is going to be ubiquitous automation and there is a need to change our diets and to possibly think about how we feed the new population that’s growing in Nigeria and the middle class in China.

It was very clear to me that we can’t feed the world under a Western diet like we eat in the US. Then you try and find a solution and what I’ve found through robotics is you really need to find a team of experts from industry that knows the industry and that can read the tea leaves, if you will, and know what direction it’s really going. The more I looked at VegTech™ and climate and some of the growth opportunities, the more excited I got about it.

And I love what you said, Elysabeth and Sasha, about driving capital. I think the ETF, beyond just being an opportunity for some people to think about investing, it’s really helping drive capital in a really efficient way and can democratize investing for people that want to make a change in the world. So I love what you’re doing. I’m glad to be on board. It’s exciting.

Exchange Traded Funds (ETF) are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Shares may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns. The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus and summary prospectus (if available) contains this and other important information about the investment company, and it may be obtained by calling +1 424-237-8393 or visiting https://EATV.VegTechInvest.com

New episodes are out every week. Never miss the Plantbased Business Hour or Minute. Subscribe on iTunes and Youtube, and sign up for the newsletter. Follow Elysabeth on Linkedin. For information on Plant Powered Consulting, click here.